Looking for value in your insurance? You’ll find it with Southern States Insurance.

Learn About Southern States Insurance

It’s hard to believe that it’s been 30 years since the start of Southern States Insurance, but as we look toward the next 30 years, we are excited to continue delivering insurance with great value to businesses and families across the United States. Over the years, we’ve grown into one of the largest privately-held independent insurance agencies in the Southeast, but we’ve always stayed true to who we are at the heart of our agency—family-owned.

“Southern States Insurance offers class A service to all of their clients. We have been working with Southern States Insurance for over five years, and have an amazing and professional partnership with them.”

Ena F.

We’re Not Your Average Agency

When you work with SSI, you’re part of something bigger and more important than just insurance. You’re part of our family. And as a member of our family, we’re here to help you protect your future and your dreams with insurance backed by a lifelong relationship with you. Because at our core, we are dedicated to helping people thrive by providing peace of mind.

Our Core Values

Passionate Advocate for Others

Creative Problem Solver

Grow or Die

Get Stuff Done

Great Attitude

Large Enough to Serve You, Small Enough to Care

With multiple offices across Georgia, we are proud to offer insurance to businesses and families like yours throughout the United States—all with the focus of helping you find peace of mind and protection.

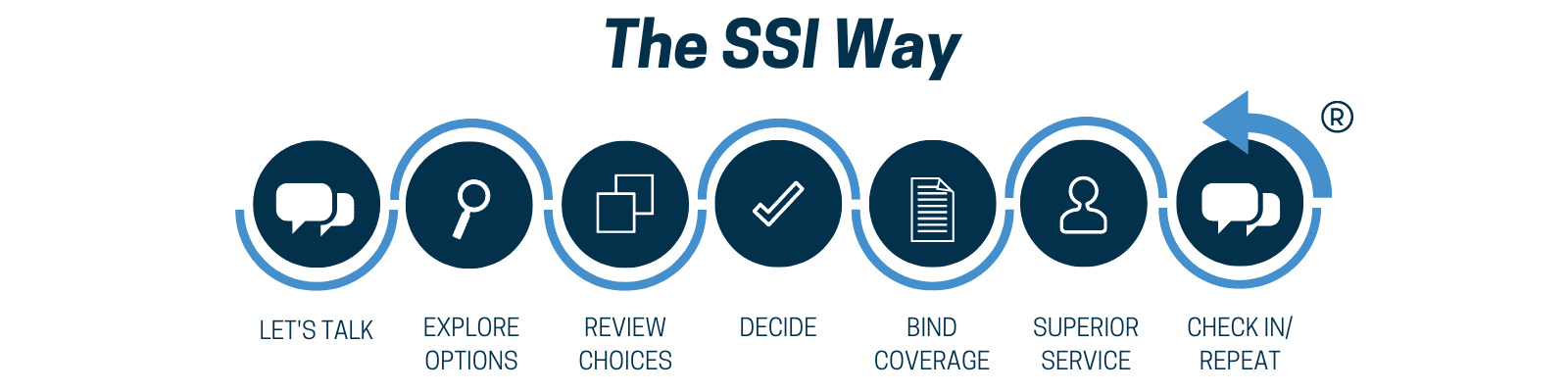

Insurance the SSI Way

Turning conversations into possibilities. Developing partnerships that empower you with options to protect what’s important. Delivering world-class service. It’s that simple.

As a business owner, you've worked hard to build a solid business. But what happens when the unexpected happens? Are you covered?

A business owners policy is uniquely designed to protect your most important assets, including your business, its continuation, your employees, and your way of life. Discuss the details of this coverage with your agent and ensure that you're protected.

If you perform services for others, you are at risk of not doing the work correctly (errors) or not doing it at all (omissions). Lawsuits can arise claiming the error or omission harmed your client and caused them a financial loss.

Errors and omissions liability insurance protects any business that gives advice, makes educated recommendations, designs solutions, or represents the needs of others. Ensure you have this important coverage if you perform services for clients.

Directors and officers (such as board members) are exposed to increased risk factors and are held accountable for acts that claim negligence in the performance of their duties. Any resulting lawsuits are typically expensive to defend, resulting in potentially large settlements.

Obtain comprehensive coverage to protect senior individuals of your company. Directors and officers liability insurance provides coverage for the legal costs to defend a covered lawsuit and provides the money necessary for any settlement beyond the defense costs.

What happens when your business faces a large liability loss that exceeds the basic limit of your standard policy?

A commercial umbrella policy provides high limits of insurance, typically between $2,000,000 and $10,000,000. Coverage is extended over your general liability insurance, workers' compensation, business auto, as well as directors and officers liability coverage. It provides a great safety net and helps ensure your business is well protected.

Businesses are susceptible to many risks, such as claims due to bodily injury, property damage, personal injury, and more.

General liability insurance is an absolute necessity for any business. It provides broad coverage when you are deemed responsible and liable, and will also pay to defend any covered lawsuit or action regardless of its merit.

What will you do if one of your trusted employees is found guilty of doing something dishonest?

Crime and fidelity coverage is designed to provide coverage for employee dishonesty, forgery and depository, theft, destruction and disappearance, and more. Discuss the details of this coverage with your agent to learn more.

Could your business cause damage to the environment? If so, are you covered?

Environmental insurance provides protection if an environmental catastrophe occurs.

With technology performing many tasks in today's world, a breakdown can cause a significant financial burden, including the cost to repair the equipment, the interruption of your business, as well as any lost income and extra expenses.

Comprehensive coverage provides protection against equipment mechanical breakdown. Discuss the details of what's covered with your insurance agent.

If one of your employees receives an injury or becomes ill due to a work-related occurrence, you are required by law to have the proper coverage in place.

Workers' compensation protects your employees should a job-related injury or sickness occur during the course of employment. This coverage is required by law, so be sure that you understand your obligations.

An auto accident can cause bodily injury or property damage to others for which you are responsible, potentially putting your business in financial jeopardy.

Business auto insurance provides coverage for vehicles owned or leased by a commercial enterprise and provides coverage for bodily injury, property damage, and other coverages, and includes both comprehensive and collision coverage.

On average, it's estimated that three out of five businesses will be sued by their employees. While there is nothing you can do to prevent someone from filing a lawsuit, there is something you can do to limit the costs of defending a legal claim.

Obtain employment practices liability insurance to protect your business and its directors, officers, and employees from alleged employment-related acts such as wrongful termination, failure to promote, discrimination, and sexual harassment.

The Internet has spun a whole new web of liability exposures. E-commerce, social networking, cloud storage, and other technologies bring great benefits to large and small businesses alike. But with these benefits also come challenges, including protection of privacy, data, and financial information of your customers.

Cyber liability coverage covers unauthorized access to electronic data or software within your network. It also provides coverage for spreading a virus, computer theft, extortion, or any unintentional act, mistake, error, or omission made by an employee. This coverage is quickly becoming more and more important as you embrace technology to help run your businesses.

What would you do if a fire impacted the operation of your business? Or what if a pipe leak caused a system outage or extended downtime? These and other events can destroy your ability to serve clients and bring in revenue, which can have a major long-term impact on the viability of your business.

Business income insurance compensates you for lost income if the business cannot operate as normal due to damage that is covered under your commercial property insurance policy, such as fire or water damage. Business interruption insurance covers the revenue you would have earned, based on your financial records, had the incident not occurred. The policy also covers operating expenses, like electricity, that continue even though business activities have come to a temporary halt.

Your business property is a significant financial investment. What if something happens to it?

Commercial property insurance can help protect the property your business owns or leases, including things like equipment, inventory, furniture, and fixtures. Whether you own your building or lease your workspace, commercial property insurance can be purchased separately or can be combined with other necessary coverage to protect your business’ physical assets.

Click it. Read it. Cover it.

- Click on the hotspots.

- Discover your risks.

- Explore coverage options.

Not what you’re looking for?

Explore more interactive graphics.

We Care About Our Clients

Hear what some of our 6,000 clients have said about Southern States Insurance.

“Southern States Insurance is a pleasure to work with. They have always responded quickly to my questions and concerns. They are professional, friendly and care about their customers. I highly recommend them!”

Beth P.

“Southern States continues to impress with its prompt, professional service. Supportive and helpful in resolving my many questions and handling the evolving needs of the company.”

Tom P.

“We are always so well taken care of at Southern States Insurance. They have always been so helpful and kind and watch out for us. Great customer service and great products!”

Irene W.

Manage Your Policies

Already a client of Southern States Insurance? Visit our Service Center to make requests and manage your insurance.

Let’s Get Started

Contact Southern States Insurance

"*" indicates required fields

Don’t like forms? Contact us at 678-715-9513 or support@southernstatesinsurance.com.